Trading Case ST1

Case Objectives

To understand how a market maker hedges the price

risk from inventory changes by applying delta hedging and other delta based

option trading strategies. To gain

experience with real world option support systems.

Key Concepts

Delta hedging and trading in a world where prices

evolve in continuous time but trading takes place at discrete points in time (approximately

every two weeks*). Trading takes place

in an idealized constant volatility

world. You get to adjust your position

at realized bi-weekly prices.

Case

Environment

In this case you will be

trading for a firm that makes money from trading options for clients at a

"premium" above its estimated competitive market price. Your trading problem is to hedge this source of profit from option

trading activities.

In the FTS markets, stock

prices will evolve in continuous time, but you can trade only at discrete

points in time. Your trading performance

is evaluated by the amount of money you make as well as ensuring that the

market value of your position does not fall below a pre-specified floor. This guarantees that the profits from option

trading activities do not fall below target levels.

In the FTS markets you

will have access to a set of real-time analytical support tools that enable you

to monitor the delta of your position

at each point in time. The description

of how to link the FTS Trader to the real time support system is described at

the end of this case.

Market Environment

The Stock Market

The stock market trades

the stock of IMB, a large computer manufacturer. Although this stock has suffered from major

price corrections over it's recent history, analysts

expect that these corrections are finished.

The following statistical process describes how prices are expected to

evolve over the next twelve months:

|

Volatility of return (): |

30% per annum |

|

Spot Price: |

346.826 |

|

Drift (): |

5% per annum |

|

Unit of Time: |

Approximately 2 weeks

(15 seconds FTS time divided by 375 seconds in default case) |

In addition, due to the

recent weakness in the IMB stock, analysts forecast no dividend payments over

the next twelve months.

Trading in this stock is

permitted at the displayed bid/ask prices that are updated bi-weekly. At the end of twelve months each share you

own is marked to the realized market price.

The Treasury Strip Market

The second security

market trades a zero-coupon bond with zero default risk. This is known as a Treasury strip. This strip security pays $900 at the close of

the market regardless of which path the stock market takes.

The European Options Markets

The

The time to maturity for

each option is approximately twelve months and the terminal payoff for each

option depends upon the realized value for IMB after the FTS markets are

closed.

For example, options with

a strike price equal to 320, have the following

terminal values:

Terminal value:

![]()

At the end of their life,

options are automatically exercised if they are "in the money."

Trader Endowments

As traders your task is

to manage the exposure of your position to price

risk. There are two types of initial

trading endowments that you may start with.

These are referred to as type A and type B. Each position type reflects the different

option trading activities of a firm.

If you are type A then

you have an initial non-tradable position in call options. If you are type B this non-tradable position

is in put options.

|

Type A |

Endowments |

|

Treasury Strips |

113 units |

|

Call 320 |

-1,000 shares |

|

Put 320 |

0 |

|

Call 360 |

0 |

|

Put 360 |

0 |

|

Type B |

Endowments |

|

Treasury Strips |

45 units |

|

Call 320 |

0 |

|

Put 320 |

+1,000 |

|

Call 360 |

0 |

|

Put 360 |

0 |

Implicit in each initial

position is a "profit" from trading call options (put options) with

clients at prices slightly higher than theoretical prices.

In both cases this profit

is approximately $53,500 market cash, and your trading objective is to lock

into a floor to this profit for the firm.

Trading Restrictions

You can trade in the

stock and the treasury strip markets. Up

to 10000 shares can be purchased or sold in these markets in any one

transaction (i.e., one click of the mouse).

You can trade a large number by repeating a transaction many times.

Option trading is not

permitted. As a result, you must manage

your position's exposure to price risk by only trading in the stock and

treasury markets.

Shortselling

in the stock and treasury markets is permitted. This allows you to borrow (lend) at

the risk-free rate by shortselling (buying) treasury

strips.

Holding market cash pays

zero interest and borrowing is not permitted in the cash market. If you want to buy securities but have

insufficient cash you must first shortsell the

required amount of treasury strips and then purchase the desired amount of

stock.

The spot risk-free rate

of interest for a Treasury strip is currently 3.25% per annum

. This rate is not expected to

change over the next twelve months.

Trading Objective

Your trading objective is

to earn as much grade cash as

possible.

Earning Grade Cash

You can make money by

buying and selling securities for market cash over approximately twelve months

of calendar time. This period of time is

referred to as one trading trial.

At the start of a trial

your initial endowment is either type A or type B, and an independent path for

the stock prices is generated (starting from the spot price of 347).

If at the end of any

trial you have a closing balance of $45,000 market cash then you will earn $6

of grade cash. If you have a closing

balance of market cash that is lower than $45,000 then you will earn $0 of

grade cash. Any amount of market cash

that is greater than $45,000 and less than or equal to $200,000 earns grade

cash as follows:

![]()

Above $200,000 market

cash earns the maximum grade cash for one trial which is $10.

Trading is conducted over a number of independent

trials and a record of your cumulative grade cash is maintained.

Linking to the Trading

Support

Download the trading support spreadsheet from the

Virtual Classroom page and open it in Excel.

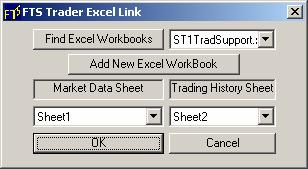

Launch the FTS Trader and link to the market. In FTS Trader click on the File menu and

select Excel Link from the sub menu items.

The following screen will pop up.

Select the spreadsheet titled ST1TradSupport and be sure to select Sheet

1 as the Market Data Sheet and Sheet 2 as the Trading History Sheet as depicted

below:

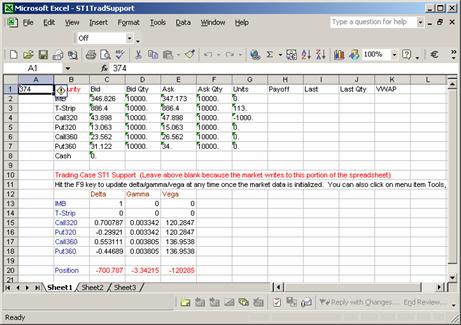

Click OK and the spreadsheet is automatically linked

to the market. By giving focus to the

spreadsheet (i.e., resize so it is on the same screen as your trading window),

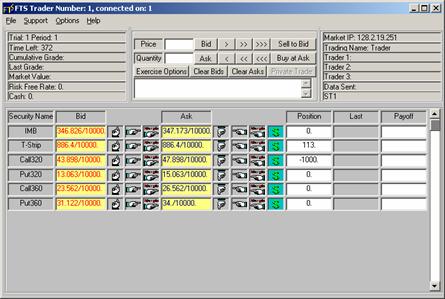

you can see your position Greeks update in real time. The spreadsheet support is illustrated below:

Corresponding

Trading Screen in the FTS Trader

Notes:

* The exact

length of time a period maps into is 15 seconds between ticks divided by a

total of 375 seconds for the year. So

this is just over 2-weeks (0.04*52 = 2.08).