FTS Market

Microstructure Treatments

Including

Quote and

Order Driven Markets

FTS supports the

following market microstructures:

·

The

continuous double auction (default setting for most cases)

o

All traders

can make market (submit bids and asks) and take market (hit bids or asks

submitted by others)

o

Every

trader sees all the bids and asks posted

§ Though the moderator can hide this or make

this visible for everyone from the Microstructure menu item; if it is hidden,

then only the best bid-ask is shown

·

A call

market

o

This is

initiated from the Microstructure menu item

o

In this

market, everyone can submit bids and asks.

At the end of the period, if there are crossing bids and asks, these are crossed at a single price that maximizes the

volume of trade. If there is an interval

of prices that maximize the trading volume, the average of that interval is

chosen (so the surplus is split between the buyers and sellers)

·

A

pre-opening call market

o

This is

the same as the call market, except that at the end of the call market trading,

the uncrossed bids and asks remain in the system for the start of the trading

in a double auction

·

A pure

order driven market

o

In this

market, every trader can submit an offer or buy and/or an offer to sell. These are shown in a limit order book visible

to everyone; the highest buy offer and the lowest sell offer are also shown to

everyone.

§ The moderator can hide these, as above,

though the best offers are still shown.

o

Trade

takes place when a bid comes in that exceeds an existing ask (at the existing

ask) or when an ask comes in that is less than an

existing bid (at the existing bid).

o

The has

to be set in the case spreadsheet

o

·

A pure

quote driven market

o

In this

market, there is a distinction between market makers and markets takers.

§ Only market makers can submit quotes

(bids/asks)

§ Market takers can submit buy and sell orders

§ The buy and sell orders are visible to the

market makers only

§ The best quotes are visible to everyone

§ Market makers can fill orders by double

clicking on the order in the book

·

But

these have to satisfy price and time priority

§ The market makers/takers have to be specified

in the case spreadsheet

·

Other

microstructure variations

o

Privately

negotiated trades

§ In any of the treatments above, you can also

allow privately negotiated trades. In

this setting, trader 1 privately sends a message to trader 2 suggesting a

trade. If trader 2 accepts, the trade is

executed and reported to all traders.

§ This has to be set in the case spreadsheet

o

Block

trades

§ A trader can be given a short or long

position in a security, and be required to trade out of that position before

they can trade it for their own account.

§ If they do not trade out of that position,

they do not earn any payoff in that security

§ This has to be set in the case spreadsheet

Details and

Examples

The following

examples use Case RE1_1 which is the 1-stock version of RE1. All the variations below are in the case

spreadsheet titled Market Efficiency Cases (ftsStdRE.xls).

The main

microstructure treatments are implemented in the case spreadsheet and are in

the “trader type” data in the case spreadsheet.

This data starts in Column A Row 20. It is shown for the different microstructure

treatments below.

RE1_1: Double Auction

|

Trader

Data |

Type 1 |

Type 2 |

|

Cash |

2000 |

2000 |

|

Endow 1 |

100 |

100 |

|

Rights 1 |

0 |

0 |

This case has two

trader types. The first type starts with

2000 in cash and an initial position (endowment) of 100 of the first security. The row titled “Right 1” controls the trading

rights of trader type 1. It is set to 0,

which means the trader can submit bids and asks (“make market”), and accept bids

and asks made by others (“take market”).

The possible values are:

0 = No restrictions on market making or market

taking

1 = Market making rights only (i.e., can only bid

to buy or ask to sell),

2 = Market taking rights only (can only buy from

ask or sell to bid)

3 = No trading rights in the security (permits

creating a non tradable position).

4 = Bid rights only

5 = Ask rights only

6 = Buy rights only

7 = Sell rights only

8 = Buying rights only (Bid + Buy)

9 = Selling rights only (Ask + Sell)

So even within the

double auction, you can restrict market making and market taking activity by

changing these numbers. The maximum

number of traders and the number of trader types determines exactly how many

traders of each type there actually are within the system. For example, if the maximum number of traders

is 60 and the number of trader types is 2, then the system will create 30

type-1 traders and 30 type-2 traders.

The first student to log in will be type 1; the second will be type 2,

the third type 1, and so on. If the maximum number of traders is 60 and you

have 7 trader types, the system will create 8 types of each trader and 4

additional type 1 traders (7*8+4=60).

The first, 8th, 15th,…

will be type 1. The maximum number of

traders is specified in cell B5 of the spreadsheet and you also have to specify

the number of trader types below this in cell B6:

|

Maximum

Number of Traders |

60 |

|

Number of

Trader Types |

2 |

Note that in student

markets, if you have too few market makers and they don’t submit bids and asks,

there will be no liquidity. For this reason,

the default setting in most FTS cases is to set the trading rights of every

trader type at 0, which allows everyone to bid and ask.

In a double auction,

trading takes place as follows:

·

A market

maker submits a bid from the trading area at the top right by typing in a price

and a quantity, and clicking “Submit Bid”.

This is shown to everyone. If

market taker hits the bid (clicks “Sell to Bid”), the market maker buys and the

market taker sells.

·

A market

maker submits an ask by typing in a price and quantity and clicking “Submit

Ask.” This is shown to everyone. If market taker hits the

ask (clicks “Buy at Ask”), the market maker sells and the market taker

buys.

·

If a bid

exceeds the ask, the two are crossed by the system at

the price that existed first (so if a bid was submitted prior to the ask, the

cross takes place at the bid price).

·

The

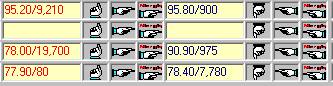

outstanding bids and asks are shown to everyone, e.g.

·

Bids can

be raised, and asks lowered, by typing in the entries and submitting either the

bid or the ask, or by using the hand signals. Similarly, you can Sell to Bid or Buy at Ask

with the hand signals:

·

The hand

pointing up raises the bid, the first hand pointing right sells, the hand

pointing down lowers the ask, and the first hand pointing left buys at the ask

(the second hand (with the little red writing on it) buys or sells on margin if

the case allows it).

RE1_1_B: Block Trades

The trader type part

of the spreadsheet is:

|

Trader

Data |

Type 1 |

Type 2 |

Type 3 |

|

Cash |

2000 |

2000 |

1000 |

|

Endow 1 |

100 |

100 |

200 |

|

Rights 1 |

0 |

0 |

10 |

You can see that the

third trader type has rights for the first security set at 10. This means that they first need to sell their

initial endowment/position of 200 units of the first security before they can

do anything else. So this trader will

not be able to submit a bid or hit an ask until the

200 units have been sold.

The maximum number

of traders and number of trader types is specified in cells B5 and B6:

|

Maximum

Number of Traders |

60 |

|

Number of

Trader Types |

3 |

This means that

there will be 20 traders of each type.

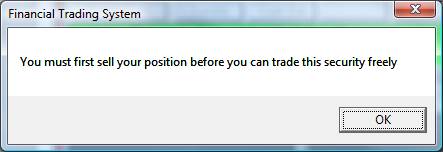

If a type 3 trader

tries to submit a bid or hit an ask, the trader will

receive the following message:

After the 200 units

have been sold, they are free to trade normaly.

RE1_1_O: Order Driven Market

Case RE1_1_O has the

following data:

|

Trader

Data |

Type 1 |

Type 2 |

Type 3 |

|

Cash |

2000 |

2000 |

2000 |

|

Endow 1 |

100 |

100 |

100 |

|

Trading

Rights |

1 |

1 |

1 |

The trading rights

mean that everyone can only submit bids and asks. The trading area looks like this:

You can see that the

“Sell to Bid” and “Buy at Ask” buttons are disabled. In this market, trade takes place when a bid crosses

with an ask. In

essence, what happens is that a bid is interpreted as a buy order and an ask is interpreted as a sell order. All these orders are displayed in the book,

and trade takes place when there is a cross.

RE1_1_Q: Quote Driven Market

This is the most

complex but also most realistic setting.

There are specific market makers and market takers, but the market maker

has additional ability to fill orders.

The case information looks as follows:

|

Maximum

Number of Traders |

60 |

|

|

|

Number of

Trader Types |

11 |

|

|

|

Trader

Data |

Type MM |

Type 1 |

Type 2 |

|

Cash |

3000 |

2000 |

2000 |

|

Endow 1 |

0 |

100 |

100 |

|

Trading

Rights |

101 |

102 |

102 |

Types 3-10 are

identical to types 1 and 2. With 60 traders

in all, this means there are 6 traders of Type MM with trading rights set at

101 and 54 traders with trading rights set at 102. “MM” obviously stands for “market maker.”

The market makers

are the only ones allowed to post quotes (bids and asks). The market takers can see the best bid or ask

submitted by the market makers and they can see their own orders; they can also

submit buy or sell orders. The trading

area for market takers then looks as follows:

For the market maker,

the trade area lets them enter bids and asks normally:

Everyone sees the

best bid-ask posted by the market makers.

The market makers also see the buy and sell orders. If a market maker wants to fill an order,

they simply double click it to fill it:

Note: in the book

menu, a trader has the option of seeing the entire book or just their own book

(i.e. the bids and asks they have submitted).

When viewing their own book, double clicking on an entry clears that bid

or ask. A

market maker sees the buy and sells orders, and fills an order by double

clicking on it.

Trading targets: Another variation is to specify a trading

target. Here, the trading type is

specified at e.g. 101/75/20. This is interpreted as: this is type 101 (as above), and they have to

end the trading trial with 75 units of the security. If they end up with N units, they are charged

a penalty equal to 20*ABS(75-N).

Pure market makers: You may want to run a treatment where a

market maker has the incentive to provide liquidity. A type 201 is identical to type 101 except

that they do not receive any payoffs from any security. Therefore, their final cash comes entirely

from trading. So if they do not provide

any liquidity, there is no profit. Note

that simply positing bids and asks in not enough; to make money, they need to

post bids and asks at which otgher traders are

willing to trade.

Other Variations

You can also set

other trading limits by editing the case spreadsheet before running the

case. The case template has the

following fields. The area in light

green applies to everything; the area in light yellow is security specific.

|

Number of

Securities |

1 |

Name |

ABC |

|

Maximum

Number of Trials |

8 |

Security

Type |

Stock |

|

Number of

Periods per Trial |

2 |

Price

Quotes |

Endogenous |

|

Period

Length (seconds) |

300 |

Start

Life |

1 |

|

Maximum

Number of Traders |

60 |

End Life |

2 |

|

Number of

Trader Types |

2 |

Short

selling |

Yes |

|

Market

Depth |

10 |

Quote to

Price Formula |

Quote |

|

Depth

Displayed |

5 |

Information |

Yes |

|

Borrowing

Allowed |

Yes/No |

|

|

|

Last Row

with Exogenous Prices |

|

Magintrade |

No |

|

Number of

Information Types |

9 |

|

|

|

Last Row

with Information |

36 |

|

|

|

|

|

Private

Trade |

No |

|

|

|

Max Qty

(type specific) |

5000/5000 |

|

|

|

|

|

|

|

|

Price

Bounds |

0,50 |

In the light green part,

borrowing is type specific. So in the

example shown here, trader type 1 is allowed to borrow, trader type 2 is not.

In the light yellow

part, you can set private trades to yes to allow students to negotiate prices

directly without it being shown to anyone else; if they do trade privately, the

trade is reported to everyone.

The Max Qty set the

maximum quantity per trade. This is also

type-specific.

Finally, you can set

price bounds; as shown, the minimum quote is zero and the maximum quote is 50.

Private Trades

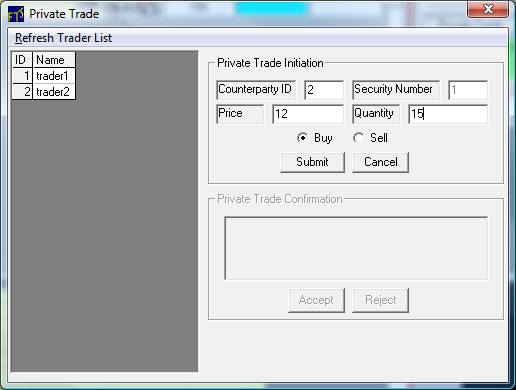

If you permit

private trades, the “Private Trade” button in the trade area becomes enabled:

Clicking it brings

up the following window, where we have entered some data:

On the left, you see

the list of traders and their ID’s. We

are asking trader2 if they would be willing to buy 15 units of security 1 at

the price of 12 each. Once the Submit

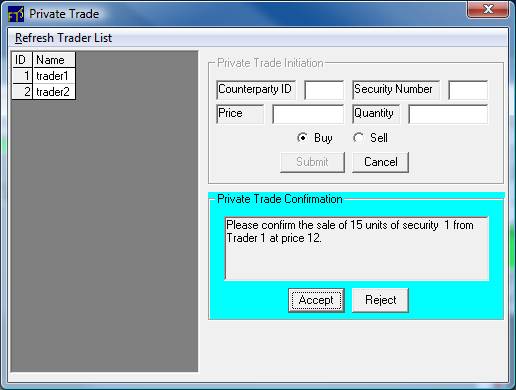

button is clicked, trader2 sees the following:

They can now accept

or reject the trade. If accepted, it is

shown to everyone in the Last column of every trader:

![]()

The trader who

initiated the trade is told of the acceptance or rejection of the offer.

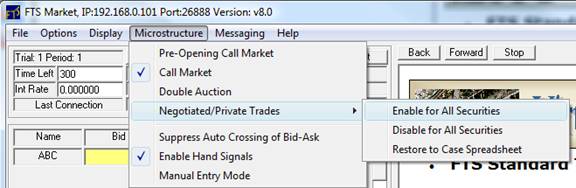

Call Markets

You can convert a

double auction to a call market prior to

the start of a trading period from the Microstructure menu item of the FTS

Market:

As you can see, this

menu item also lets you control other settings:

·

If you

suppress auto crossing of bids and asks, then if a student enters a bid greater

than the ask, it will not be crossed, instead, both

will be shown until someone acts on it.

o

Further

note: if the same student enters a bid and ask, and the bid exceeds the ask, it will not be crossed, irrespective of the menu

setting.

·

You can

enable or disable hand signals. This is

useful if you want to slow down the trading

·

If you

select Manual Entry mode, then every entry has to be typed in afresh. For example, suppose a student enters a bid

of 12 for 50 units. This stays in the

entry area, and so to re-enter the bid, the numbers do not have to be typed

again, the student can simply keep clicking the “Submit Bid” button. In manual entry mode, the bid would have to

be retyped before any button could be clicked.

·

You can

also enable or disable privately negotiated trades; this can only be done prior

to the start of the period.

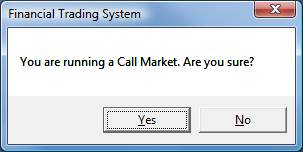

Returning to the

call market, if you select it, you will be asked to confirm that you want to

run a call market:

After confirmation, the trader displays change

to the following:

![]()

So the Bid and Ask columns

have been replaced by “Price” and “Volume” columns.

Trading proceeds as

follows. Students

enter bids and asks. These are

displayed in the book though you can suppress the display from the Display menu

of the FTS Market.

If there is a cross,

then the trade takes place, and the price and volume traded are reported to

everyone. If you hide the display of the

book, no one sees the process of bidding and asking, so information is only

transmitted when a trade takes place.

In a pre-opening call market, the same

process takes place, except that at the end of the call market, the outstanding

bids and asks are used to start off the double auction; you have to manually

select the double auction; this way, you can run multiple rounds of the

pre-opening call market prior to the double auction.