![]() Example 3:

Computing Implied Foreign Rates from a Currency Forward Price

Example 3:

Computing Implied Foreign Rates from a Currency Forward Price

The

objective of the following exercise is to illustrate how the covered interest

rate parity theorem applies to the real world markets. In this application we will apply the FTS

Futures Calculator to infer the Euribor (or Eibor as it is also referred to)

which is the euro benchmark in continental

Consider

the following data:

On

Spot Rate

(USD/EUR (Currency in USD)): 1.0269

30 Day

Forward 1.0254

60 Day

Forward 1.024

90 Day

Forward 1.0228

Spot Rate

(EUR/USD (USD in Currency)): 0.9738

30 Day

Forward 0.9752

60 Day

Forward 0.9766

90 Day

Forward 0.9777

Money

Rates: Late

1

Month 1.4%

3

Month 1.4%

6

Month 1.46%

12 Month

1.51%

Question:

What are the implied Euribor rates (in continuously compounded form)

given the above currency forward rates?

To answer

this question we apply the covered interest rate parity relationship to the

spot and forward markets using LIBOR as the USD offshore deposit rate and solve

for the implied Euribor offshore deposit rates.

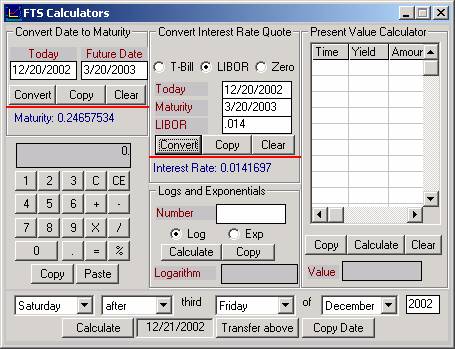

Step 1: Launch the FTS

Futures Calculator from the virtual classroom and select Calculator

from the menu items as illustrated below.

We first

convert the USD LIBOR to continuously compounded form. Select LIBOR and enter the 3-month spot LIBOR

rate as a decimal and then click on Convert.

The implied continuous compounded rate is provided as follows

(0.0141697):

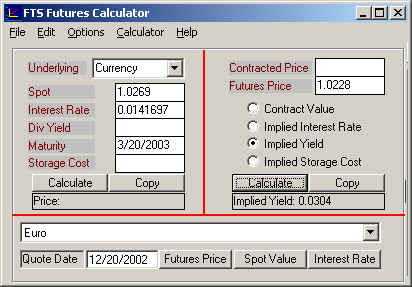

Step 2:

Launch the FTS Futures Module from the Virtual Classroom and enter the

following information:

Remark:

You can enter dates directly or you can enter the date as a decimal time

to maturity. The decimal time to

maturity can also be calculated using the FTS Calculator in step 1 if you want

to. This is not necessary, however,

because the date can be entered directly as illustrated below:

Important Note: When applying the Cost of carry model to solve for the

currency forward price or an implied input, there are two interest rates

required. The domestic rate and the

foreign rate. However, domestic and

foreign rates are relative terms and so the “domestic rate” is the cost of

financial carry in the currency the price is measured in. This is because the synthetic forward

requires borrowing in the currency the price is measured in at the domestic

rate, converting at the spot rate and depositing at the other rate of interest. As a result, the “foreign rate” is equivalent

to a dividend from this deposit. In the

FTS Futures Calculator the dividend yield is the foreign rate of interest for a

currency forward.

Required

Inputs to Calculator to Solve for the Implied 90-day Euribor rate of interest

(continuously compounded).

Spot Rate

(USD/EUR) 1.0269

USD LIBOR

rate (90-days continuously compounded)) 0.014697

Quote date

Screen 1:

Entering dates (Quote Date and Maturity Date (alternatively you could

enter the decimal time to maturity beside maturity if you want to) directly,

and solving for the implied foreign rate (Dividend Yield) directly. In the right hand side of the screen click

beside Implied Yield:

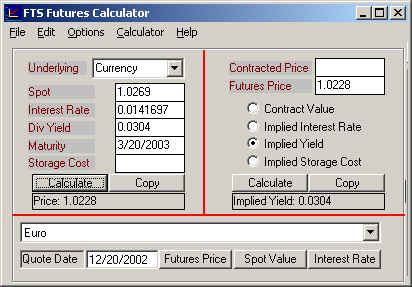

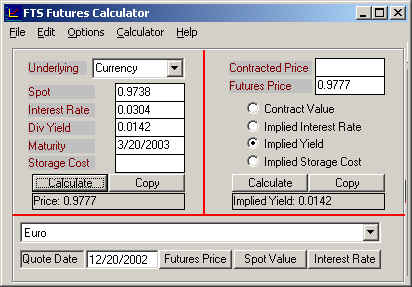

Screen 2:

Verifying that the implied foreign rate supports the observed market

price of 1.0228. To do this in the

screen below we will enter 0.0304 directly beside the Div Yield and then

calculate the price by clicking on Calculate.

You can observe the answer is provided on the left side of the screen.

Step 3:

Interpretation

Observe

that covered interest rate parity relationship implies that the forward points

must favor the USD because interest rates are lower in the

i.

Deposit $1 at USD LIBOR

for 90–days, or

ii.

Convert $1 at the spot

exchange rate (= EUR/USD euros), deposit at Euribor (1+Euribor*90/360) for

90-days and at the same time enter

into a 90-day forward contract to convert (EUR/USD*(1+Euribor*90/360) Euros to

USD in 90-days.

Both i.

and ii. can be executed at the same time and both result in USD at the end of

90-days. As a result, both should result

in exactly the same number of USD to avoid creating an arbitrage

opportunity. But this implies that the

spot and forward rates must be consistent with the deposit rates for each

country. If the USD deposit rate is

lower than the Euro deposit rate then the forward rate must adjust so that the

USD is priced to appreciate against the Euro.

You can see this by contrasting the spot exchange rate (1 euro buys

1.0269 USD on December 20, but in 3-months time 1 Euro is exchanged at 1.0228

USD in the forward contract. That is, 1

euro buys less USD in 3-months time at this forward rate. The amount less exactly compensates for the

difference between the two 3-month deposit rates.

Step 4:

Additional Question: How does the way exchange rate are measured

matter?

To answer

this question we will repeat the above exercise by working with EUR/USD and

assuming that the 90-day continuously compounded deposit rate for the Euro is

0.0304.

In this

exercise the domestic rate is now the Euro rate (0.0304) and the foreign rate

(i.e., dividend yield) is the USD rate (0.0142). The right side of the screen computes the

implied Yield (which in this case is the USD Libor rate continuously

compounded) and in the Left side of the screen we enter this rate directly to

verify the forward price.

Thus it

does not matter which unit of measure you work with (i.e., USD/EUR or EUR/USD)

so long as you are consistent in the application of the inputs.

(C) Copyright 2003, OS Financial Trading

System