![]() Example 3: European and American Options

Example 3: European and American Options

Exercise:

In a three-period binomial world, explain

the difference between the values of European and American options.

To conduct

this exercise, select the “Binomial Tree” module from the Virtual Classroom:

You will

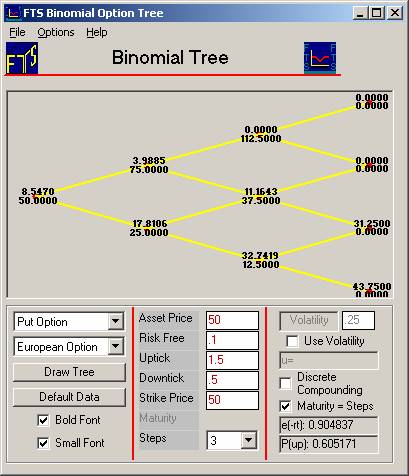

see a three-period binomial tree displayed with the following Action and

Display Screen.

The tree

displayed is that of the underlying asset, which in this problem we will

interpret as a stock. You can see that

the stock price is initially 50, and then moves to either 75 or down to 25, and

so on. The default values have the

strike price also at 50, so the options are “at the money.”

Let us

look at the trees for European and American put options using the default

parameters. The above screen has the

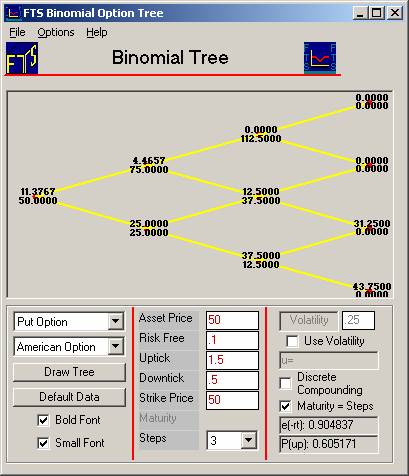

default provided for the European Option (see drop down above). Below we depict the equivalent screen for the

American put option by changing the drop down to American.

You can

see that the European put is valued at 8.547 while the American put is worth

11.377. Comparing the trees, you can see

that they differ along the bottom-most path.

After two downticks, the European put is worth 32.742 while the American

put is worth 37.50. At this node, the

stock price is 12.5, so the intrinsic value of the put is 37.50. The numbers in the tree show you that if you

do not exercise the put, it is worth 32.742 while if you exercise it, it is worth

37.50. Consequently, it is “rational” to exercise the put before maturity.

Let us

verify this by calculating the value of the put if you did not exercise. In the next period, the put would be worth

either 43.75 (if there was a further downtick) or 31.25 (if there was a

subsequent uptick).

The risk neutral probability is given by the formula: ![]()

Here, r is

1 plus the risk free interest rate, u is the uptick

parameter and d is the downtick parameter.

For our values, r = ![]() ,

u = 2, and d = .5. This implies that p =

0.605171 (as shown in the action window).

Using the principle of risk-neutral valuation, we find that the value of

the put option at the node is:

,

u = 2, and d = .5. This implies that p =

0.605171 (as shown in the action window).

Using the principle of risk-neutral valuation, we find that the value of

the put option at the node is:

![]()

Therefore,

the difference between the European and American option values is caused by the

fact that after two downticks, you would exercise the American style option.

©2003

OS Financial Trading System